The recent coordinates of "Emergency Superwoman" Yu Ying often appear in Chengdu.

Since November 2018, when the Beijing Waterfront Neighborhood Clinic, which she founded for two years, was acquired by Penguin Almond Clinic, Yu Ying also joined the senior management team of Penguin Almond Group and was busy with the upgrade of Chengdu Penguin Doctor Clinic.

Located in Shuian South Street, Chaoyang District, Beijing, the clinic is the first chain community clinic that Yu Ying originally planned to build, which is positioned as minor emergency and general medical home care. What the industry didn’t expect was that it merged into the penguin almond territory so quickly.

Earlier in August 2018, the Penguin Doctor and the Almond Doctor merged, and the merged Penguin Almond included 33 clinics covering 8 cities.

The clinic industry, which was originally at the end of China’s medical system, has ushered in the best development stage in recent years. The top-level design unties the policy for the development of clinic industry. However, many forces continue to increase the investment and construction of clinics, and the commercial tide of clinics has never really declined.

"In the field of non-public medical investment, if a hospital is established, the investment of the hospital is heavy. A hospital needs hundreds of millions of funds, and the cultivation period is long, while the investment in clinics is much smaller and the market demand is great." Xie Rushi, chairman of Shenzhen Shangyihui Health Management Co., Ltd. told the health sector.

At present, in addition to a number of companies, the main way to lay out offline medical care is clinics, such as penguin almonds, micro-medicine, lilac gardens, etc. Doctor V, foreign-funded medical institutions, listed companies and even central enterprises have all invested in the clinic field in the past two years.

For a time, the wind and cloud will meet. The clinic world is more lively than ever. The number of clinics in China is increasing by 6,000 ~ 7,000/year, and there are no fewer than 60 new chain clinic brands that have obtained financing from 2010 to 2018. The vigorous development of clinics also reflects the new opportunities for Chinese society to run medicine in the new period.

Incoming person asked

Is running a clinic a good business? Should our doctors leave the system to open a clinic? How to realize the commercial landing of the clinic and how to solve its payment problem? Be a high-end clinic or a low-end clinic?

According to the business objects, there are six main types of clinics: community clinics within the government system, individual clinics, chain-operated clinics, clinics with Internet medical enterprises, doctors’ brand clinics with personal IP, and clinics with large medical groups.

In May this year, the National Health and Wellness Commission, the National Development and Reform Commission, the Ministry of Finance, the Ministry of Human Resources and Social Security and the National Medical Insurance Bureau formulated the Opinions on Promoting the Development of Clinics, proposing to pilot in ten major cities and change the examination and approval of clinics into filing management.

In accordance with the requirements of the document, doctors who have been practicing in medical institutions for five years and obtained intermediate or above titles are encouraged to set up specialized clinics full-time or part-time. Coupled with the gradual spread of doctors and nurses’ multi-point practice, theoretically, the source of talents in clinics has channels, and more doctors will have the conditions to enter the clinic industry.

Xie Rushi told the health sector that when doctors go to the market to start their own businesses, the clinic is indeed a good way to cut in, with low cost and controllable risks.

However, Xie Rushi, who has served the public medical system for many years and participated in the formation of a doctor group and joined the society to run a doctor, also said that doctors and operators in the clinic should be separated. "Doctors are doctors, operators are operators, and doctors can be transformed into operation managers, but it is difficult to hold two positions, except for individual clinics. The new clinics that are truly commercialized must achieve the separation of the above identities."

Although it is not mature enough, the clinic industry has shown a diversified pattern. No matter whether it is a low-cost route or a high-end play, there are typical cases, and it shows distinct regionality.

The ten pilot cities of this filing system are: Beijing, Shenyang, Shanghai, Nanjing, Hangzhou, Wuhan, Guangzhou, Shenzhen, Chengdu and Xi ‘an. "Obviously, the north, Guangzhou and Shenzhen, plus six provincial capital cities, are all cities with good social medical environment and relatively rich doctor resources." Xie Rushi analyzed.

However, it is also one of the top ten pilot cities, and the different regional characteristics of its clinic development are very distinct.

Chengdu model: cheap chain small clinic

The focus of Yu Ying’s work in 2019 is to transform and upgrade the Penguin Doctor Clinic in Chengdu. Chengdu is a strategic place in clinic. As early as 2015, there were nearly 4,000 clinics in Chengdu, ranking second in the country.

Gao Zhe, the founder of the clinic lock industry, thinks that in terms of clinic development, many places are still "from 0 to 1" and are talking about how to build a clinic, but in Chengdu, there has been some competition among clinics. At present, brands are concentrated in the core area of Chengdu, and there is an oversupply, so the competition of Chengdu clinic brands is also very fierce.

"So if you don’t visit Chengdu as a chain clinic, I think it is a pity."

Gao Zhe suggested developing clinic practitioners in other cities and looking at the local market in comparison with Chengdu. The first is the policy, whether doctors are really open to practice more, whether companies can register clinics, and whether there are good policies on the department setting of clinics.

The second is to look at the concentration of local medical resources. Chengdu’s medical resources are relatively concentrated, and residents in most areas are far away from seeing a doctor; At the same time, as the center of the southwest, a large number of people gather in Chengdu, and residents in the urban-rural fringe or on the edge of Chengdu have no place to go to see a doctor, so the demand for clinics has become just needed.

How long is the break-even period of the clinic? The health sector has collected the opinions of dozens of clinic operators all over the country, and the answers are mostly concentrated in three to five years. The shortest answer comes from Dr. Lu in Chengdu.

Lv Fengping, founder of Dr. Lu’s chain clinic in Chengdu, said that the breakeven of the clinic is at most one year. "Therefore, we must strictly control costs and ensure that medical services that can meet the needs of grassroots units are provided at low cost."

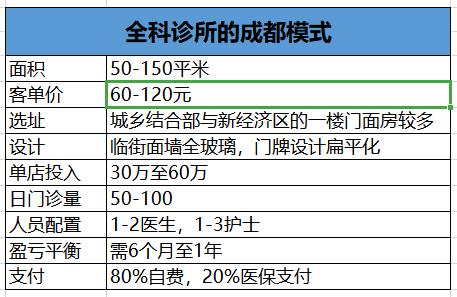

Dr. Lu and other well-run clinics in Chengdu market have similar characteristics, such as small single store area, strict cost control and chain operation.

Huang Xianjin, the founder of Xiezhuo Medical, also in Chengdu, has more than 20 years of experience in primary clinics. In 2012, in order to explore the future direction, Huang Xianjin also studied MBA. Huang Xianjin said that this period of time has become a turning point for himself, and it is clear that the chain-like brand clinic is the future development direction, and he officially began to explore the chain-like model of the clinic that suits him.

Huang Xianjin turned all the big clinics out, leaving only the small clinics. This kind of operation mode has the advantages of low cost of opening a store, quick recovery, quick replication, low cost of trial and error, and easy investment and financing. For patients, the operating cost is low, the customer unit price is low, and the cost performance is very high under the premise of ensuring the quality of medical services.

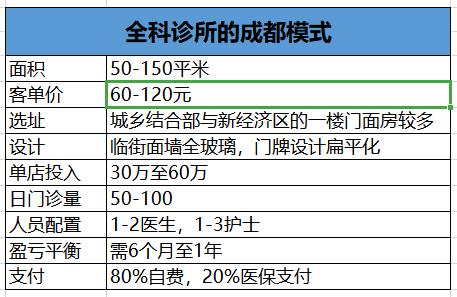

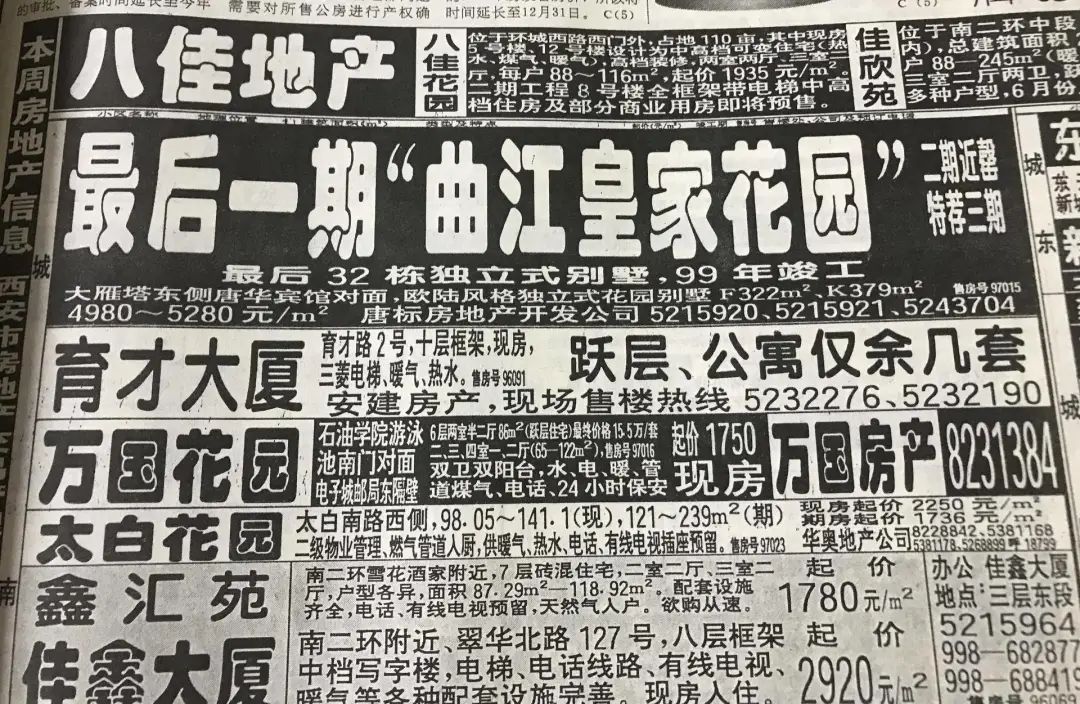

Like chain hotpot restaurants, clinics in Chengdu take a cost-effective route. Gao Zhe put forward the theory of "Chengdu model" and gave the operating parameters of Chengdu model clinics.

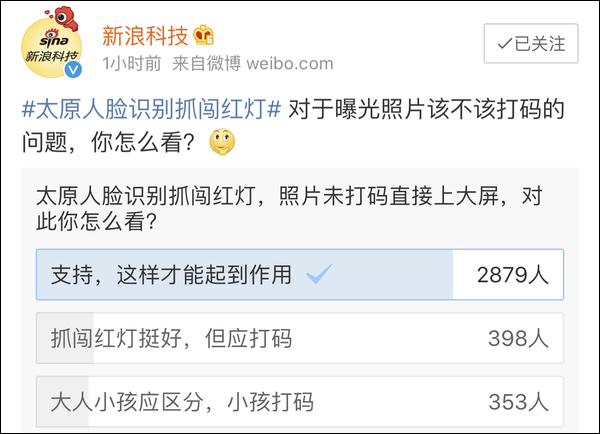

Source: Gao Zhe, the clinic.

According to the survey of the health sector, among the top ten pilot cities, there is nothing more "affordable" than opening a clinic in Chengdu. In Nanjing, the capital city, the founder of a general practice clinic said that although it is not convenient to disclose specific data, its single store investment and break-even period greatly exceed the "Chengdu model". Kong Xiangjun, executive director of Taibao Pediatrics, the first professional pediatric clinic in Nanjing, told the health sector that his pediatric clinic invested about 4 million yuan in a single store, and the break-even time was expected to be two to three years.

Internet model: online and offline linkage

Hangzhou is one of the cities with a good social environment for medical treatment. In fact, as early as 2014, the Hangzhou government issued implementation opinions on promoting the development of health service industry and encouraged individuals to open clinics. At the same time, Hangzhou’s rich internet entrepreneurial atmosphere has led to a number of offline clinics hatched by Internet medical enterprises, such as Lilac Clinic, Micro-medicine General Practice Center, and good doctors next door.

But looking at the whole country, Internet medical care is not the only one in Hangzhou. Almond doctors from Shanghai and penguin doctors rooted in Chengdu must have names. The merger of the above two companies in August last year made today’s Penguin Almond Group more eye-catching.

In April this year, Penguin Almond completed a new round of financing of US$ 250 million. According to CEO Wang Shirui, nearly 50 clinics that Penguin Almond has landed in the country currently cover general clinics, centers, specialist clinics and other formats. In 2021, Penguin Almond plans to deploy more than 500 offline medical institutions.

That is, in the next 2-3 years, from 50 to 500, Penguin Almond will give the rapid expansion schedule of offline medical institutions. "Based on our rich experience in site selection, construction, license acquisition, physician training and marketing of offline medical institutions, a relatively mature management and operation system has been initially formed," Penguin Almond said.

The leading investors in this round of financing include Tencent and Country Garden Venture Capital, and they still get a large amount of financing in the cold winter of capital, which itself shows that the capital side has a firm endorsement attitude towards the industry prospects.

Penguin Almond Group aims to build a complete network of online and offline medical institutions, from online internet medical care to offline primary medical care, specialist centers and surgery centers, and build a complete business model of medical associations. "We will restructure an orderly and accessible medical system through self-construction or mergers and acquisitions."

Beijing-Shanghai Model: Leveraging Mature Commercial Insurance

Unlike Chengdu, Beijing and Shanghai are rich in medical resources and have a complete medical supporting system. In such a first-tier city, high-end clinics can survive better, Xie Rushi believes.

Lanhai Clinic is located in Lujiazui World Trade Center, Shanghai, which used to be the tallest building in China and now the fifth building in China, and is one of the most expensive commercial buildings in Shanghai. The comprehensive outpatient department of Lanhai Clinic, which is located in the high-end foreign affairs, has a single area of more than 10,000 square meters.

According to the information, Lanhai Clinic has three floors, covering an area of over 10,000 square meters. At present, there are 16 specialized departments such as general practice, internal medicine, surgery, stomatology and dermatology, and there will be special outpatient clinics such as orthopedics, rehabilitation medicine and 24-hour pediatrics in the future; There are also two daytime operation centers, as well as several characteristic centers such as endoscopy center and optometry center.

The health sector calls the outpatient department to get a pricing, and the same department first visits 800 yuan and then visits 500 yuan. If it is necessary to make an appointment with a senior expert, the registration fee is 3,000 to 5,000 yuan.

Lanhai Medical behind Lanhai Clinic is a medical industry investment service enterprise listed on the main board of Shanghai Stock Exchange. At present, the second high-end comprehensive outpatient department, Yihe Lanhaimen Clinic, built by Lanhai Medical Center, has also landed, and it is located in Huaihai Road business district, where the rent is equally expensive.

Wang Haijun, the dean of these two clinics, said that diversified medical models to meet the needs of different groups will increasingly become a choice for people, but supporting commercial insurance is indispensable.

He revealed that in terms of the support of commercial insurance, Lanhai Medical has an advantage, that is, relying on the resources of the entire Lanhai Group and joining hands with Shanghai Life Insurance, it strives to build and penetrate the industrial chain of its own related medical business, forming a business insurance introduction to promote medical promotion, and medical promotion feeds back market transformation, thus promoting the virtuous circle of commercial insurance promotion, which is also called "medical insurance linkage" by him.

At present, the two outpatient clinics of Lanhai Medical have been docked with more than 20 commercial insurance companies.

Lanhai Medical is a microcosm of high-end clinics rooted in first-tier cities with relatively rich and perfect medical resources. Xie Rushi expressed greater affirmation to the development of clinic industry in Beijing and Shanghai. He believes that the development of clinics in Guangzhou and Shenzhen has not matched its status as a city at the forefront of reform. "Compared with the development of clinics in Beijing and Shanghai, there is still a gap." The biggest reason is that commercial insurance in Beijing and Shanghai is more developed.

Caesar mode: closed-loop emergence

In fact, commercial insurance not only provides payment for high-end clinics, but also commercial insurance companies themselves have set foot in clinics.

On May 18, 2018, Taikang Life Insurance invested more than 2 billion yuan to acquire 51.56% equity of Baibo Dental, and Baibo Dental’s net profit continued to lose money in the past two years; In 2017, its operating income was 1.434 billion yuan and its net profit loss was 793 million yuan.

The acquisition of high-end chain medical institutions has become an important way for Taikang to land "medical insurance+medical services". "Building a closed loop between medical insurance and medical services is conducive to reducing medical costs." Chen Dongsheng, Chairman and CEO of Taikang Insurance Group, compared the American Caesars medical model and described the development prospect of Taikang.

Caesars Medical Group is the creator of HMO model in the United States, the largest HMO in the United States at present, and the originator of managed medical care. Its "medical+insurance" operation mode, that is, after selling insurance products to customers, the enterprise is not only the provider of medical services, but also the payer of medical expenses, and the benefit of doctors and patients is called integrated medical care.

"Caesar model should be the most well-known and respected American’ medical+insurance’ industrial model in China industry, and its experience and lessons have a strong reference significance for the development direction of health insurance industry in China." Wang Guangying, executive partner of Fuxin Investment, believes.

Taikang relies on the background of insurance capital, integrates the resources of big health industry, and pushes forward the downstream industry in depth. In order to further advance in pediatrics, rehabilitation, hospice care and other specialized fields, the acquisition of chain medical entities such as Baibo Dental has become an important way for Taikang to land "medical insurance+medical services". In this way, Taikang can form a closed loop of "health insurance and medical services".

In an interview with the health sector, Wang Shirui said many times that the benchmark of Penguin Almond Group is also Caesar model. At present, Penguin Almond Group plans to cooperate with commercial insurance companies, integrate insurance product resources, and launch HMO-type medical insurance financial solutions for Penguin doctor customers, so as to reduce customers’ medical expenses through scientific and perfect health management services and fee control mechanisms.

Also to the health sector, there is the establishment of soldiers by the president of China Resources Medical. As a medical group with the background of central enterprises and a listed company, China Resources Medical has played a big game on medical services, and the relying point is its quietly laid-out fast clinic.

As early as a few years ago, China Resources Medical has quietly opened an Urgent Care Clinic in Shunyi, Beijing. Since December 2015, China Resources Phoenix, the predecessor of China Resources Medical, has introduced a brand-new UCC express clinic model, aiming at creating a number of community clinics with good medical service quality and affordable prices.

In 2017, China Resources Phoenix opened 10 UCC express clinics in Yanshan District, Beijing, imitating the model of American express clinics, and uniformly upgraded the service environment and service process of its community health service centers (stations).

Under Caesar’s medical system, the convenience clinics in the United States are mainly based on commercial insurance and self-funded payment. At first, UCC of China Resources Phoenix relied on the reconstruction of existing community health service centers, guided by the service price of public community medical institutions, and paid mainly by urban residents’ medical insurance.

However, commercial insurance is still the direction of UCC’s cooperation. At that time, Wu Potao, executive director and chief executive officer of China Resources Phoenix, publicly stated that China’s medical group and health insurance have great strategic synergy space, and China Resources Phoenix is willing to cooperate with health insurance companies in multiple dimensions. He specifically pointed out that it was the UCC business of China Resources Phoenix that sent a warm invitation to insurance companies.

Play prediction: rural areas surround cities

Obviously, whether it is insurance companies, medical groups with the background of central enterprises or internet medical care, many domestic institutions regard "Caesar Medical" as the standard.

The author once lived in the United States from 2012 to 2014, and the active activity area is Silicon Valley in Northern California, which is in the core coverage area of Caesars Medical.

There are 38 hospitals under Caesar Group, and the area of each hospital is covered with medical centers for outpatient service. There are more than 600 medical centers in the United States, that is, clinics.

When I lived in Silicon Valley, I learned that some big companies, such as Google and Facebook, even invited Caesar to open a clinic in their company and sent doctors to provide services for their employees.

In the process of giving birth in 2013, all the prenatal examinations and postpartum reexaminations were completed in the clinic of the doctor of my choice, and I didn’t go to the hospital where the doctor cooperated until I gave birth, and I experienced the indispensability of the clinic around me in Caesar’s model.

As Wang Guangying said, under the guidance of the "Healthy China" program, Caesars Medical, as the originator and successful model of managed medical care and HMO, deserves in-depth study and reference from the medical industry and health insurance industry in China.

China Resources Medical tries to establish a regional cooperative medical system, focusing on a graded diagnosis and treatment system and a new type of community service diagnosis and treatment chain system (UCC Express Clinic), so as to increase the accessibility and affordability of patients in the areas covered by the RIDS medical cooperation system.

Taikang is far from the only insurance company that exerts the synergistic effect of insurance and medical care. Taking Ping An Group as an example, it focuses on the "big medical health" industry, including medical services, medical insurance, commercial insurance and health cloud, and realizes online and offline integration through carriers such as Ping An Good Doctor and Wanjia Clinic, integrates multi-party medical resources, and builds a whole-process health management and medical service platform.

Even the chain clinics that started with doctors’ personal entrepreneurship and eventually became a climate all hold the goal of integrating into RIDS. The founder of Dr. Lu in Chengdu said that in the future, Dr. Lu should be "ubiquitous and accessible" and truly solve the problem of "difficulty in seeing a doctor" at the doorstep of ordinary people.

It is estimated that in the next 10 years, the domestic primary health care market will reach more than 3 trillion yuan, and the growth rate will exceed 20%. At this growth rate, there will be a cheap clinic next to every two hot pot restaurants in Chengdu in the future.

Gao Zhe believes that compared with first-tier cities, more opportunities are given to large institutions, and the real opportunities for clinics in the future are in third-and fourth-tier cities, because the health needs of residents in third-and fourth-tier cities are the same. Under the circumstances of lower cost, easier site selection and easier increase in outpatient service, the "rural encircling the city" may be really good.

The diversified medical model to meet the needs of different groups needs multi-participation, and only by realizing accessibility and affordability can the clinic, as the end of the medical system, undertake its due mission in building a healthy China era.