Just now! Vanke responds to everything

China fund newspaper

China fund newspaper Taylor

Just now, Vanke issued an announcement to respond to many recent incidents.

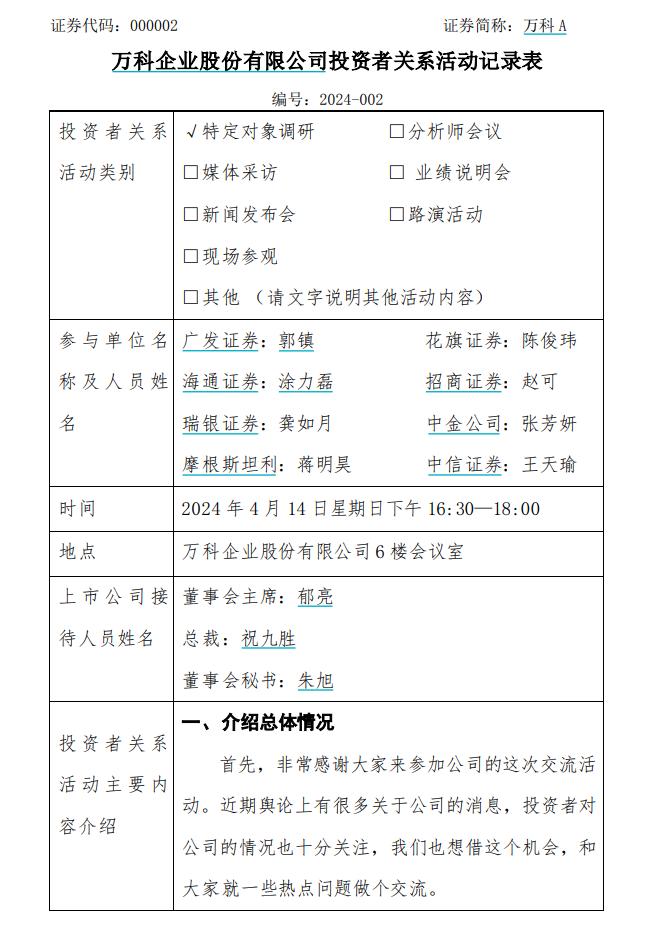

On the afternoon of April 14th, Vanke held an offline investor meeting, accepted institutional research, and many well-known brokers participated. Yu Liang, Chairman of the Board of Directors of Vanke, and Zhu Jiusheng, President of Vanke, were responsible for the reception and exchanged views with investors on some hot issues.

Taylor sorted out some of the main points.

1. Operation of Vanke

At present, Vanke has indeed encountered phased operational difficulties, and its liquidity is under pressure in the short term. However, a package of stable operation and debt reduction plans has been formulated, which can properly resolve these stage pressures.

Vanke said that it will make full use of all kinds of existing financing tools and actively mobilize all front-line forces to make good use of a series of policy financing tools issued by the central government that are conducive to the industry to resolve risks. I am confident that the debt scale of Vanke will drop by 100 billion yuan this year and next, and the debt risk will be substantially resolved. Vanke solemnly promises that all projects of Vanke Group will be delivered on time and with high quality.

2. What caused the current challenge?

Vanke said that there are three reasons.

First, although Vanke was the first in the industry to realize the need for transformation and development, there are problems of taking too big steps and rushing in the actual operation process. The transformation business exceeds the matching ability of resources, takes up too much development business funds, and the scale is too large to keep up with the management ability, and the business objectives cannot be achieved as planned.

Second, we have failed to resolutely get rid of the inertia of the industry. In many cities, including some key cities and first-tier cities, there have been rash investments and mistakes. After the central government clearly put forward the high-quality development goals and requirements of the industry, it failed to make a more thorough adjustment to the "three highs" model prevalent in the industry, resulting in a passive situation today.

Third, the understanding of the trend change of financing mode was not comprehensive enough at first. The group has started the adjustment of real estate financing mode, but it still needs a process to change from total credit financing to new financing mode.

3. Respond to the market’s doubts about the management’s self-interest.

In the recent negative public opinion, there are some doubts about the moral hazard of management.

Vanke said that there is no management seeking personal gain. Today, it seems that some past models and practices have not adapted to the new development stage of the industry, and will be comprehensively reviewed and sorted out to formulate corresponding strategies. If violations are found, they will be actively rectified; If illegal problems are found, the group will not tolerate them.

4. Current relationship with shareholders

Vanke said that it has made a detailed report with Shenzhen SASAC and major shareholders. Shenzhen State-owned Assets Supervision and Administration Commission and Shenzhen Metro support Vanke as always. During the market adjustment period, the company is fortunate to have the full support and trust of Shenzhen state-owned assets and major shareholders, and is deeply grateful for this, and will cherish the trust and redouble its efforts.

5. Respond to the real name report about Yantai.

Vanke said that the real-name reporting company was mainly a subsidiary of Yantai Riying Group, whose actual controller was Li Jun. Yantai Vanke and its partner Li Jun (hereinafter referred to as "Yantai Partner") have cooperated in developing real estate projects for nearly 10 years and cooperated in 7 projects.

Since 2021, affected by the overall market environment, the sales of many projects in Yantai fell short of expectations, and the profits could not reach the initial feasibility study index. In order to ensure the funds needed for project construction delivery and normal operation, the funds of the project company cannot be distributed according to the wishes of Yantai partners. At the same time, Yantai partners, as shareholders, ignored the needs of the project company’s construction, delivery and normal operation, and put forward a huge demand of 1.6 billion yuan without reasonable basis. Although Yantai Vanke and Yantai partners have communicated many times, they have never reached an agreement. Yantai partners subsequently reported to the government, public security, tax bureau, CSRC, Shenzhen Stock Exchange and other institutions many times, and exposed them in the media many times.

Vanke said that the Yantai informant reported the case of Vanke’s misappropriation of funds to the Yantai public security organ in 2023 and was accepted. After three months of investigation and evidence collection, Yantai Public Security Bureau made a decision not to file a case in November 2023.

In addition, the tax authorities inspected Yantai Vanke, and Vanke did not refuse to pay the accounts. At present, the tax authorities have not determined that Yantai Vanke has the subjective intention to evade taxes.

Vanke also said that there is no private interest of the so-called Vanke management team in the cooperative project. Vanke began to implement the project follow-up plan in 2014. According to the existing system, Vanke’s directors, supervisors and senior management personnel are not allowed to participate in the project follow-up, let alone get any personal benefits from the cooperative project.

Employees and investors are all minority shareholders, and they have equal rights with other shareholders and bear the same shareholder obligations, so there is no particularity.

In April, 2024, Yantai partners slandered the company and the chairman of the board of directors on the Internet, which had a bad nature and influence. Vanke Group is bringing a civil lawsuit to the court and reporting a criminal case to the public security organ.

6. Xiao Jin’s being taken away by the public security organs has nothing to do with Yantai.

Vanke said that Xiao Jin was an individual case and had nothing to do with Yantai’s report. The Group has arranged for the Beijing regional and Jinan companies to communicate with the Jinan Political and Legal Committee and the police investigating the case. The police said that Xiao Jin’s case was his personal case and had nothing to do with Yantai’s report.

Vanke also said that the Jinan Municipal Political and Legal Committee said that the Xiao Jin incident was a personal issue, which should be distinguished from the normal business activities of Vanke Group and Jinan Vanke. As always, it will support Vanke’s business development in Jinan and help the implementation of the strategy of "strengthening the province". In the guarantee delivery work, if the political and legal system services are needed, special personnel will be arranged to coordinate and dock.

7. Are executives controlled by the border?

What is the situation of Cai Ping and Wang Runchuan, the leaders who have not returned from abroad? It is rumored that after Cai Ping, the head of Central China, went to the United States and never returned, all the vice presidents and above of Vanke Group are now under border control.

For Vanke, the actual situation is that Cai Ping, the former chief partner of Central China, was born in the United States, and now he has reached the stage of receiving education and needs family companionship. It resigned in 2023 and obtained the company’s consent.

Wang Runchuan, the former lead partner of the headquarters collaboration center, resigned because he went to Hong Kong for further study. At present, he lives in Shenzhen.

The overseas business trips of the management of the Group are normal. Zhu Jiusheng, president of the group, has just returned from an inspection project in Hong Kong. Baoquan Zhu, co-president of the Group, flew to Japan for business investigation at noon on April 14th.

Recently, Vanke A’s share price has seen a wave of decline, with a large short-term decline. As of April 12, the latest market value was 76.7 billion yuan.

Welcome to read April 14th.

China Fund reported on Public Offering of Fund.

Original title: "Just now! Vanke responds to everything "

Read the original text