Global news: US stocks keep rising. The Dow has risen seven times in a row. The price of Microsoft AI products has reached a new high.

On Tuesday, local time, driven by the unexpected earnings report of American bank stocks and the strong performance of AI concept stocks, and the market still expects to raise interest rates in July for the last time, US stocks continued their upward trend. The Dow rose for seven consecutive days, the longest consecutive rise since March 2021, and the S&P and Nasdaq once again set a new high in 15 months.

And Microsoft announced overnight that Office AI tool pricing is an important catalyst for market performance. At the global partner conference held on Tuesday, Microsoft disclosed that for subscribers of Office 365 E3, E5, Business Standard Edition and Business Advanced Edition, Microsoft 365 Copilot will be uniformly priced at $30 per user per month. According to official website’s pricing, these subscription services for enterprise users range from $12.5 to $38 per month per user.

This also means that through the Office AI assistant tool, Microsoft has doubled or tripled the "actual pricing" of office services for business users.

The B-side pricing of AI auxiliary tools reflects the strong market demand and low operating costs. As a result, Microsoft’s share price closed up 3.98% on Tuesday, easily hitting a record high, while AI-related concept stocks were driven.

At the beginning of the earnings season, the performance of banking stocks exceeded expectations, which also boosted market sentiment to some extent. Morgan Stanley’s revenue and profit exceeded expectations. Among them, the revenue was $13.457 billion, which was significantly higher than the market expectation of $13.08 billion. Bank of America achieved revenue of $25.33 billion and EPS of $0.88 in the second quarter, both better than market expectations.

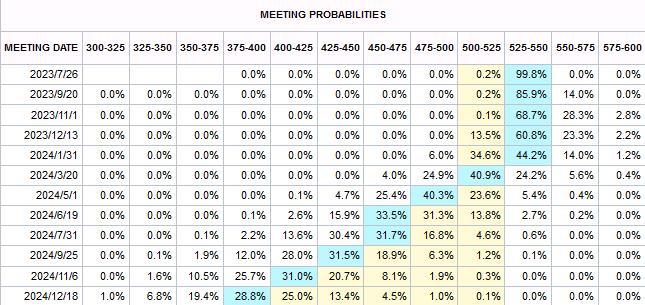

In addition to the financial report and AI news, the US retail data in June released on Tuesday was less than expected, which also showed that the tight labor market is still supporting the economic growth, and the overheating problem that the Fed is most worried about is also steadily easing. The market still expects the Fed to raise interest rates for the last time in July. CME Fed observation tools show that the probability of raising interest rates in July is close to 100%, and the probability of raising interest rates in the next few months is not great.

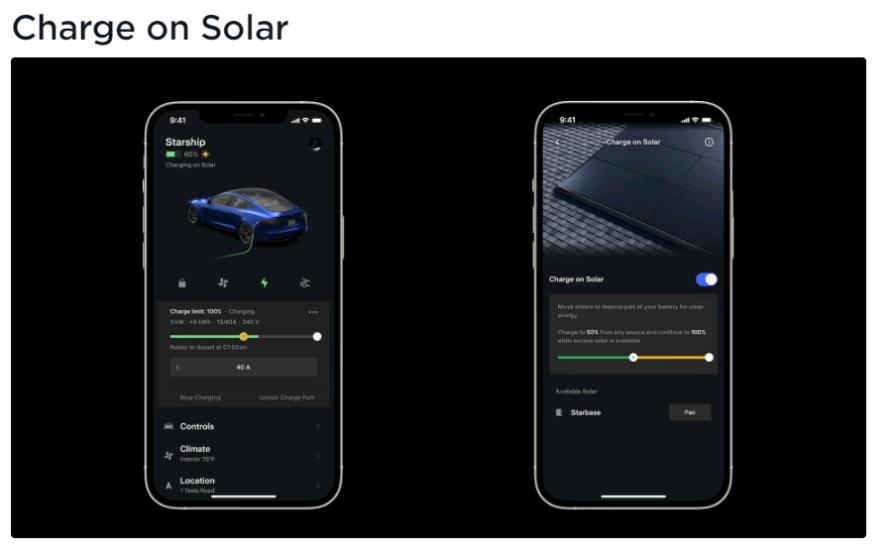

In other news, recently, Tesla officially launched a new "Charge on Solar" function to the United States and Canada, allowing Tesla owners to charge their electric vehicles using only solar energy.

Official website wrote that using surplus solar energy to charge electric vehicles can maximize the value of home solar energy system. In order to realize this function, Tesla owners need to update Tesla APP to version 4.22.5 or higher, and also have different requirements for the software versions of cars and Powerwall.

It is worth noting that on Tuesday, local time, the World Meteorological Organization warned that the heat wave sweeping across the northern hemisphere will intensify this week, leading to a soaring night temperature, which in turn increases the risk of heart attack and death.

According to the World Meteorological Organization, the heat wave is still in its early stage. It is expected that the temperature in North America, Asia, North Africa and the Mediterranean will exceed 40 degrees Celsius for several days this week, which means that the midnight temperature in some areas will hover around 30 degrees Celsius this week.

[overnight U.S. stocks]

Among the large Chinese stocks, Alibaba fell by 2.36%, Baidu by 3.63%, Netease by 2.80%, Tencent Music by 4.95% and Pinduoduo by 4.34%.

Among the large American technology stocks, Apple fell 0.13%, Amazon fell 0.55%, Google A fell 0.71%, and Nye soared 5.50%.

[global index]

In European stock markets, the FTSE 100 index rose slightly by 0.64% to 7454 points. The French CAC40 index rose slightly by 0.38% to 7319 points. Germany DAX index rose slightly by 0.35% to 16,125 points.

[global goods]

The main contract of WTI crude oil closed at $75.73 per barrel, up 2.23%; The main contract of Brent crude oil closed at $79.82 per barrel, up 1.68%; The main contract of crude oil in the previous period closed at 582.20 yuan per barrel overnight, up 1.31%.

Overnight, the Shanghai gold main contract closed up 1.16% to 460.76 yuan per gram; The main contract of Shanghai Bank closed up 1.63% to 5915.00 yuan per kilogram.

[overnight news]

US retail sales in June increased by 0.2% month-on-month, which was significantly less than expected, but key indicators suggested strong consumer demand.

After a 0.3% month-on-month increase in May, US retail sales in June increased by 0.2% month-on-month, far below the expected 0.5%. However, the retail sales of the control group (excluding automobiles, gasoline, building materials and food services) used to calculate the GDP of the United States increased by 0.2% month-on-month in May and accelerated to 0.6% month-on-month in June. This data shows that consumer demand is still strong in June.

When the US debt default crisis intensified, the two "creditors" of China and Japan threw US debts together.

In May, Japan’s US debt holdings fell to an eight-month high, with a decrease of US$ 30.4 billion, the biggest drop in seven months, and the largest reduction among major holding countries; China reduced its holdings by $22.2 billion, and its position fell for two months. In May, the capital flow of overseas investment in US securities reversed, with a net outflow of US$ 167.6 billion.

US Treasury Secretary Yellen said that multiple factors pushed inflation down, but warned against being too optimistic because of the CPI in June.

Yellen said that the cooling of the labor market plays a key role in slowing down inflation in the United States, and the pressure on housing costs and automobile prices is also declining, which is expected to continue to push down the price pressure. She also hinted that corporate profit margins may decline. However, Yellen poured cold water on the inflation data that cooled more than expected in June.

[company news]

Office 365 AI assistant is expensive, Microsoft shares hit a new high.

Microsoft announced the price list of enterprise AI software tools on Tuesday, announcing that the price of Office 365 Copilot is $30/month per user. For some users, using Copilot means that the cost will double or even triple. Microsoft also launched Bing Chat Enterprise, a more secure AI chat robot. Microsoft and Meta jointly stated that the Meta AI model named Llama 2 will be provided free of charge to developers who build software on Microsoft Azure cloud computing platform. Microsoft shares closed up 4%, a record high.

Tesla APP launches "solar charging" function

According to media reports on Tuesday, Tesla recently officially launched a new "Charge on Solar" function to the United States and Canada, allowing Tesla owners to charge their electric vehicles with only solar energy. According to the screenshot of official website’s APP, the owner can set the charging scheme for the vehicle in the "Charge on Solar" function. For example, the first 50% of the vehicle’s electricity is set to "can come from any way", and the other 50%-100% of the electricity is "only through solar energy".

The overall performance of Bank of America Morgan Stanley Q2 exceeded expectations.

The performance of American big banks is "mixed". Bank of America Q2′ s profit increased by 19% year-on-year to US$ 7.4 billion, and the growth of net interest income slowed down, but it is currently facing the pressure of commercial real estate loan business. Morgan Stanley’s net profit fell by 13% year-on-year, wealth management business reached a new high, and trading income fell by 22%. The performance of Bank of America and Morgan Stanley both exceeded expectations, and the net interest income increased greatly under the high interest rate environment. The published financial reports of the five major banks all indicate that the prospect of a soft landing of the US economy can be expected, and the market is waiting for Goldman Sachs’ financial report on Wednesday.

The "bad news" of American technology stocks: large fund positions hit the upper limit.

BlackRock’s Science and Technology Opportunity Fund is prohibited from further increasing its holdings of shares in Apple, Microsoft and NVIDIA, while JPMorgan Chase’s large-cap stock growth fund holds more shares in Microsoft, Apple, NVIDIA, Alphabet and Amazon.

Goldman Sachs sings more Baidu: It is the future that the share price of AI traffic portal will rise by 31%.

Goldman Sachs believes that Baidu will become the most profitable company in China and the main traffic portal for AI applications in the future. It will continue to be optimistic about its future profitability and raise its target price for US stocks from US$ 183 to US$ 197.

[AI dynamic]

Meta released Llama 2 model and cooperated with Microsoft and Qualcomm.

After half a year, Meta AI released the latest generation of open source model Llama 2 on Tuesday. Compared with Llama 1 released in February this year, the token used in training has doubled to 2 trillion, and Llama 2 has also doubled the most important context length limit for using large models. Llama 2 contains models with 7 billion, 13 billion and 70 billion parameters.

Meta also announced on Tuesday that it will cooperate with Microsoft cloud service Azure to launch a cloud service based on Llama2 model to global developers. In addition, Meta and Qualcomm also announced that Llama 2 will be able to run on Qualcomm chips, breaking the monopoly of NVIDIA and AMD processors on the AI industry in the market.

[financial calendar]