Cross-border communication-Cross-border e-commerce brother, after golden decade, turned to dust.

Author/Avocado under the starry sky

Editor/spinach starry sky

Typesetting/ice cream under the stars

Last week, a Notice issued by the State Administration of Foreign Exchange seemed to give foreign trade players hope.

The circular said: both regions and policies will expand and improve the level of cross-border trade and investment openness. In a word, open the door and embrace the world.

Affected by this news, related stocks ushered in an increase. Cross-border e-commerce brother (the first cross-border e-commerce company listed in A shares), cross-border communication (002640) directly pulled up the daily limit.

Source: Oriental Fortune official website-Cross-border Communication (as of December 20, 2023)

Policy support is naturally good, but is cross-border communication the lucky one who is favored again?

First, from grassroots to giants

Recalling the past, cross-border communication has also interpreted the story of "grassroots counterattack".

The predecessor of Cross-border Communication was Baiyuan Trousers Industry (all lines are 100), which was founded by Yang Jianxin (now the largest shareholder of Cross-border Communication). In 2011, it was listed on Shenzhen Stock Exchange. At this time, the 100-yuan trousers industry has nothing to do with cross-border e-commerce. The income has also been hovering below 500 million, and it has never been broken.

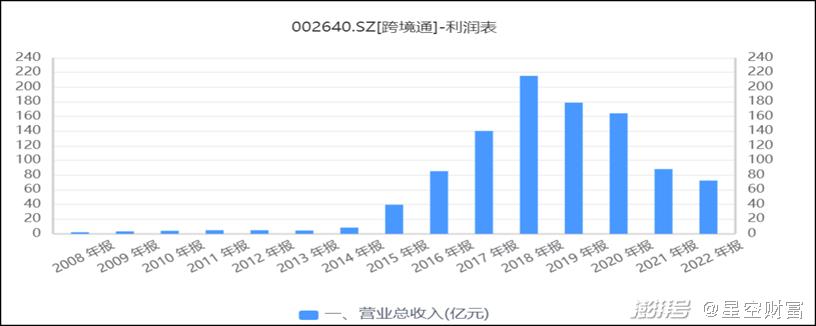

Source: flush iFinD—-operating income

The one who changed his fate was a returned scholar named Xu Jiadong. In 2007, under the background that domestic e-commerce such as Taobao and JD.COM just started and many people didn’t even know what cross-border e-commerce was, Xu Jiadong founded the first cross-border e-commerce platform in Shenzhen (business model: relying on Amazon for cross-border export).

One wants to develop and the other wants to go public. In 2014, the two brothers hit it off, and Baiyuan Trousers successfully acquired Global Tesco. In 2015, it was renamed cross-border communication. At this point, a pants seller has turned into a "cross-border e-commerce" listed company.

In the following year, the revenue of cross-border communication soared from 842 million to 3.961 billion yuan. Cross-border communication that tasted the sweetness, on the one hand, crazy mergers and acquisitions, on the other hand, massive distribution of goods. In 2016, it successively acquired Patuosun, which focuses on exporting 3C business, and Youyi e-commerce company, which mainly imports maternal and child products. Since then, it has formed a troika of Global Tesco (revenue accounted for 58% in 2018), Patoson (revenue accounted for 16% in 2018) and Youyi E-commerce (revenue accounted for 26% in 2018).

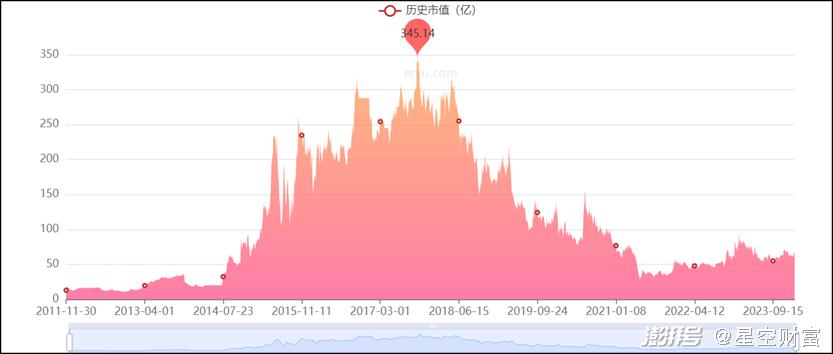

During 2015-2018, with the east wind of Amazon, the scale of cross-border communication soared. The highest revenue is 20 billion (21.5 billion in 2018), and the highest market value is nearly 40 billion. What is the concept? In the same period, another multinational e-commerce company, Lanting Jishi (LITB), which was listed on the US stock market, had a market value of only $2 billion.

Source: Yiniu. com-Cross-border communication

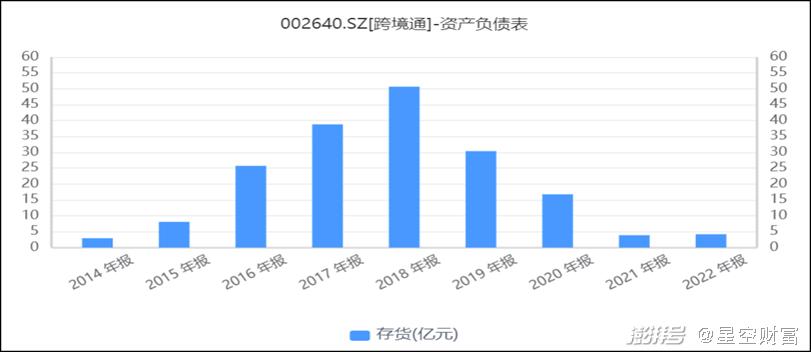

However, the mass distribution mode of blindly pursuing scale makes it form a large amount of inventory. The data shows that as of 2018, the company’s inventory reached 5.1 billion, accounting for 59% of the total current assets. Once the downstream changes, the huge inventory cannot be realized, which will directly drag it down.

Source: flush iFinD—-inventory

Second, from giants to grassroots.

Sure enough, with the constant change of platform rules, Amazon pays more and more attention to specialization and branding, and more traffic is tilted towards branded and boutique sellers, while the traffic allocated by traditional models is less and less.

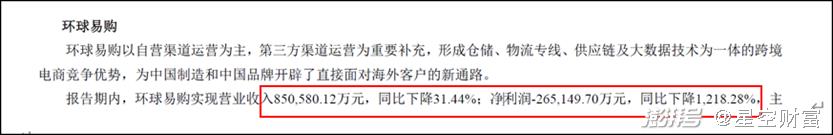

In 2019, Global Tesco’s revenue was only 8.5 billion, down 31.44% from 12.1 billion in 2018.

Source: Cross-border Communication 2019 Annual Report

In addition, the brutal distribution of goods by Global Tesco has also come to an end. The huge inventory of this mine still exploded. In 2019, nearly 2.8 billion inventories were impaired, resulting in losses. Directly led to a net profit loss of 2.7 billion in that year.

Although, cross-border communication once said: the impairment in 2019 is to clear the historical burden at one time and go into battle lightly. However, in the end, it failed to meet the turning point of performance. After 2020, cross-border communication will continue to lose money. Global Tesco, the main revenue force, is also mired in arrears of payment due to unsalable inventory.

Source: flush iFinD—-net profit returned to mother

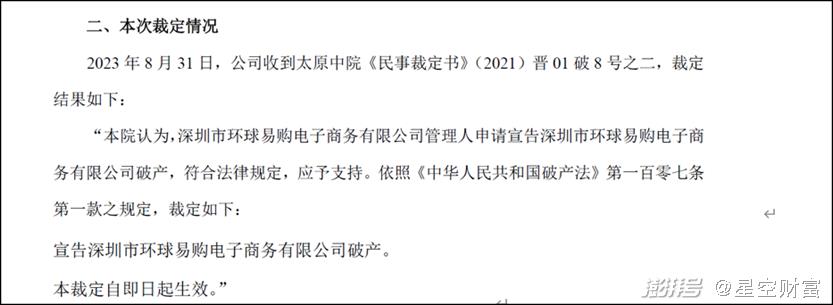

Under the predicament, cross-border communication can not survive without stopping. In 2021, Patoson was betrayed first, and then Global Tesco filed for bankruptcy. The company announcement shows that in August 2023, Global Tesco officially went bankrupt.

Source: Company Announcement (September 2, 2023)

At this point, the former cross-border giants, one of the two main forces changed hands and the other went bankrupt, and they have already fallen to the bottom.

After learning from a painful experience, cross-border communication also decided to transform itself to save itself, on the one hand, optimizing the inventory management process; On the other hand, around the branding strategy, from coarse to fine, strengthen the construction of self-operated brands. However, since 2021 (Global Tesco), income has still declined; Although the loss of net profit returned to the mother has narrowed, it is still difficult to change the trend of loss.

It is still difficult to survive after the broken arm.

Third, debt repayment is difficult, and restructuring is pending.

Business is not good, and cash flow is naturally not much better. How bad is it?

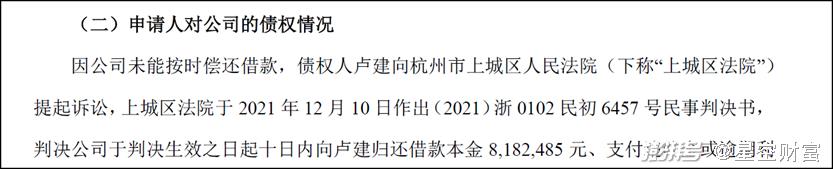

According to the company’s announcement, in 2021, due to the company’s failure to repay the debts due, the creditors resorted to the court, involving about 8.18 million yuan. The former tens of billions of giants can’t even afford 8 million at the moment.

Source: Company Announcement (May 16, 2023)

After three years, it has not been returned, and the creditors have to settle for the second best and apply for restructuring the cross-border communication. If not, I am afraid that the 8 million arrears will eventually be ruined.

The so-called reorganization is to give you a chance to save yourself. But whether it can become a turning point, the key is to have a self-help plan.

At present, the revenue of cross-border communication mainly comes from the import of maternal and child products (such as milk powder). However, the data shows that in 2022, the number of newborns in China will be 9.56 million, and experts predict that it will be 7-8 million in 2023. Under the trend of a sharp decline in the newborn population, the import of mothers and babies may not last long. According to the semi-annual report in 2023, the gross profit margin of maternity products is only 8.35%, and the period expenses are shared equally (the period expense rate is 10.53%), so the whole one can’t make ends meet.

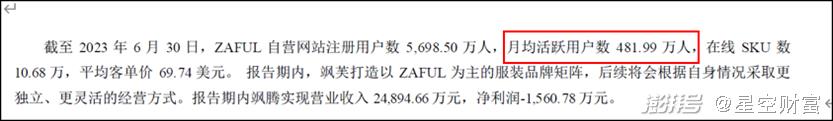

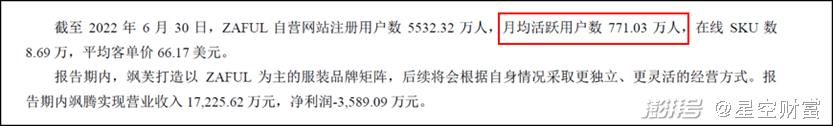

In addition, the self-operated brand ZAFUL (European and American young women’s swimwear, etc.) is another straw. However, ZAFUL, who has high hopes, tends to go downhill.

The data shows that the average monthly active number of ZAFUL online operations (offline publicity and harvesting users, online sales) is 4,819,900, which is nearly half of the same period in 2022. And the operating entity Sateng is still in the stage of burning money and losing money. It is a long way to go to expect ZAFUL to save his life.

Source: Cross-border Communication 2023 Semi-annual Report

Source: Cross-border Communication 2022 Semi-annual Report

To sum up, under the current situation, the author can’t think of any good ways to save himself. I wonder if cross-border communication can have any clever tricks. If not, it will be doomed to bankruptcy and liquidation.

In ten years, cross-border communication has reached a high-rise building, and now it is in the dust. The road ahead is long and unknown.

Note: This article does not constitute any investment advice. The stock market is risky, so you need to be cautious when entering the market. No business, no harm.